|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing Bankruptcy in Virginia: A Comprehensive Guide to Your Options and Obligations

Filing for bankruptcy in Virginia can be a viable option for individuals and businesses facing overwhelming debt. Understanding the process, requirements, and implications is crucial for making an informed decision. This guide explores the various aspects of filing bankruptcy in Virginia, helping you weigh the pros and cons effectively.

Understanding Bankruptcy Types

Chapter 7 Bankruptcy

Chapter 7, known as 'liquidation bankruptcy,' allows individuals to discharge most of their debts. It's suitable for those with limited income and substantial unsecured debts, such as credit card bills and medical expenses.

Chapter 13 Bankruptcy

Chapter 13 is often referred to as a 'wage earner's plan.' It enables individuals with regular income to create a repayment plan to pay off debts over three to five years.

The Bankruptcy Filing Process in Virginia

- Credit Counseling: Before filing, individuals must complete a credit counseling course from an approved agency.

- Filing the Petition: The process begins by filing a petition with the bankruptcy court, including detailed financial information.

- Automatic Stay: Filing triggers an automatic stay, halting most collection activities.

- Meeting of Creditors: Debtors must attend a meeting where creditors can ask questions about the financial situation.

- Discharge: If all requirements are met, the court may discharge eligible debts.

Advantages and Disadvantages of Filing for Bankruptcy

Pros

- Debt Relief: Bankruptcy can eliminate or reduce debts, offering a fresh financial start.

- Protection from Creditors: The automatic stay prevents creditors from pursuing collection activities.

Cons

- Credit Impact: Bankruptcy can significantly affect your credit score, making future borrowing more difficult.

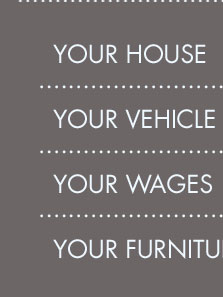

- Asset Risk: Some assets may be liquidated to pay creditors in Chapter 7 cases.

Consulting with bankruptcy lawyers in Virginia Beach VA can provide personalized guidance on navigating these complexities.

FAQs About Filing Bankruptcy in Virginia

What debts are dischargeable in bankruptcy?

Most unsecured debts, like credit card and medical debts, can be discharged. However, student loans and certain taxes may not be eligible for discharge.

How long does bankruptcy stay on my credit report?

Chapter 7 bankruptcy can remain on your credit report for up to 10 years, while Chapter 13 can stay for up to 7 years.

Can I keep my house and car if I file for bankruptcy?

In Chapter 13, you can often keep assets like a house or car, provided you continue to make payments. Chapter 7 may require liquidation unless exemptions apply.

For those considering options outside Virginia, consulting bankruptcy lawyers in Westchester County NY might offer insights tailored to that jurisdiction.

1. What Is ItAnd How Does It Work? - 2. What Are the Different Kinds of Bankruptcy Cases? - 3. Who May File for Bankruptcy? - 4. Do I Have to Go to Court? - 5. How ...

All individual debtors who file a Chapter 7 bankruptcy are required to obtain credit counseling from an approved provider within 180 days before filing for ...

To actually file, either you or your attorney, will need to file a two-page petition and several other forms at your Virginia district bankruptcy court.

![]()